You’re probably familiar with the notion that when something suddenly becomes of interest, you start to notice it everywhere. For example, remember the bright green Scion Xb I shared with you here? I had never really noticed those types of cars before; however, when I purchased it, I started seeing them pop up everywhere. I even took notice of a few in my area that were my same unique color as mine. The reality is that those cars have probably been around me for a while, yet I didn’t notice them because they weren’t of interest to me at the time.

Where am I going with this? Well last month, I took part in a personal month-long challenge of giving up sweets. Having come from an endless sugar rush over the holidays, I was ready to make a huge effort not to have those delightful cookies, cakes, candies, you-name-it for the entire (short) month of February. That’s right, no box of chocolates on Valentine’s Day for me. Try a veggie burger. It was alright, but it was no fudge truffle. Since that challenge, I’ve started noticing that if you are up for a challenge, they are everywhere! I even got a coupon at the end of my last Target trip that challenged me to use mouth wash for 21 days (Eh- not quite there yet.) At the end of “No-Sweets February”, I felt relief that I missed those confections a lot less than I thought I would and motivated to find another challenge to get me through the month of March.

My Spending Habits

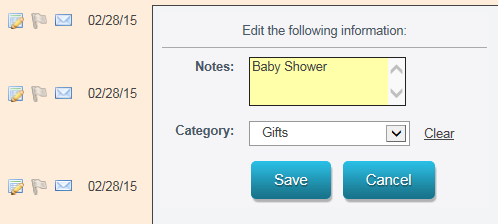

As I have mentioned before, I avoid dealing with and talking about my spending habits. I am ready to change that about me and to become more aware of what goes in and out of my accounts. One thing I love about online banking is that you can categorize your spending to see the areas that are outstanding as well as the ones that could use some help. Logix’s online banking service has allowed me to get to know myself a little bit more, even though I drag my feet the entire time. So, here it is – I’m breaking down my budget for last month in an effort to face head on what I’m up against with this next challenge.

The first thing I did after logging into my online banking account was pull up the activity in my checking for the month of February. Next, I spent a couple minutes reviewing the transactions to ensure that they were categorized the way I wanted and added comments to the ones I felt I needed to defend myself on to further explain.

After satisfactorily selecting categories, it was time for that reality check which I found after clicking on Budget across the orange bar at the top of the screen. If I cover my eyes with my hands and peer at the screen through the cracks of my fingers, will it make it less scary? Raise your hand if you think that works. Ok, good, me too. Once I took a deep breath to look at my budget, I realized that while it wasn’t the best, it wasn’t the worst either.

Apparently I excelled at having no entertainment in February – that actually was kind of sad. What I found shocking though, was how much I spent on going out to eat vs groceries for the home. I spent $277.84 dining out! Geez-Louise! I’m blaming my lack of sweets. That was just about $100 more than groceries bought for the house. February was certainly a fun month, and I guess I could lump entertainment into all that dining out, but ideally I’d love to decrease my spending in that category. My dining out budget broke down into roughly $10 a day that I could have put to better use, like furniture or paint for the new home. It’s all making a point to prioritize in ways that create a more satisfying balance for me. That is the very reason for this next challenge…

No Spending Challenge

I’ve heard of No Spending Challenges and looked for one that I could easily transition into - one that would help put my finances in perspective, teach me something invaluable, and not cause me to cave easily. The Month-Long No Spending Challenge on Andrea Dekker’s Real Life…Simplified seems promising that it can give me the results I am looking for. The rules in her challenge are fairly simple with a goal of ceasing any spending above and beyond the basics. So, I’m a day in and so far, so good! I stayed home all day, but still. Let’s go day 2!

I’ll be giving an update midway through this challenge, but tell me in the comments section below – would you ever be interested in a No Spending Challenge? Or, what are some challenges that you have taken on, whether or not you saw them through? If I could challenge myself to do a challenge a month for the rest of the year, I’d say my year would be looking pretty good and I’m already super excited at the thought of the next one and next one. Bring. It. On.