In the vast landscape of financial institutions, credit unions stand out as community-centric alternatives to traditional banks. Owned and operated by their members, these financial cooperatives prioritize serving the financial needs of their communities over maximizing profits. If you're curious about what sets credit unions apart from conventional banks and why they might be worth considering for your financial needs, you're in the right place.

Simply put, a credit union is a financial institution that operates on a not-for-profit basis and is owned and controlled by its members. Unlike traditional banks, which aim to generate profits for shareholders, credit unions focus on providing excellent financial services to their members. Their foremost mission is to prioritize the financial well-being and interests of their members above all, rather than pursuing profits for external stakeholders. Within this framework, they offer a wide range of products and services, from savings accounts and spending accounts to auto loans, personal loans, business services and mortgages, among others.

In this article, we'll delve deeper into the world of credit unions, exploring their unique characteristics, differences from banks, and the benefits they offer to members. By the end, you'll have a comprehensive understanding of what credit unions are all about and whether they might be the right fit for your financial goals and values. Let's embark on this journey to discover the advantages of belonging to a credit union and how it can positively impact your financial health.

What is a Credit Union?

A credit union is a not-for-profit financial institution that accepts deposits, offers loans, and provides a wide array of other banking services and products. Deposits are insured by the National Credit Union Share Insurance Fund (NCUSIF), which is managed by the National Credit Union Administration, commonly referred to as NCUA. Furthermore, the NCUA requires federally-chartered credit unions, such as Logix, to obtain NCUA insurance for safeguarding member deposits. Contrasting with the NCUA, bank deposits are insured by the Federal Deposit Insurance Corporation (FDIC), an independent agency of the United States government. While both government agencies offer similar protection levels, they cater to different types of financial institutions.

But what exactly does "not-for-profit" mean in this context? Essentially, it signifies that credit unions lack the profit motive of privately and publicly held banks, so they are exclusively committed to delivering exceptional financial services to their members. This fundamental distinction in approach shapes the core values and objectives of credit unions, placing a strong emphasis on prioritizing the best interests of their members over generating profits for stakeholders.

Governed by a volunteer board of directors elected by the members, credit unions make decisions to benefit their community as a whole, emphasizing member service over profit generation. As a result, any surplus earnings are reinvested back into the institution to upgrade services, increase savings yields or to add to the institution's financial strength, embodying their foundational principles and goals.

What Distinguishes Credit Unions From Banks

While both credit unions and banks offer similar financial services, there are several key distinctions between the two. At the heart of this difference is ownership: credit unions are member-owned, with all members enjoying equal voting rights regardless of the amount of money they have deposited. Banks, on the other hand, are owned by shareholders who have voting rights proportional to their investment.

Membership in credit unions is typically based on specific eligibility criteria, such as geographical location, employment, or association membership, fostering a strong sense of community and mutual support. This community-centric ethos extends to providing tailored services and active support for local initiatives, contrasting with the broader, more general customer base of banks.

The not-for-profit nature of credit unions also means that they hold a tax-exempt status from federal income taxes. This allows credit unions to allocate more resources towards providing affordable financial products and services to their members. Consequently, members benefit from lower loan rates and higher dividend earnings on deposit accounts, such as checking accounts or certificate accounts. Furthermore, credit unions are known for charging lower fees for common services, including ATM withdrawals and overdrafts, compared to their banking counterparts.

Benefits of Belonging to a Credit Union

Belonging to a credit union offers several benefits for individuals seeking financial services. Here are some of the top benefits:

- Competitive Rates: Credit unions often feature lower interest rates on loans, credit cards, and mortgages compared to traditional banks. They also tend to offer better earnings on savings products.

- Lower Fees: Members typically enjoy reduced fees for services such as ATM withdrawals, overdrafts, and account maintenance compared to traditional banks.

- Personal Touch: Credit unions are known for their personalized and member-focused service. Members often have direct access to decision-makers and can receive personalized financial advice.

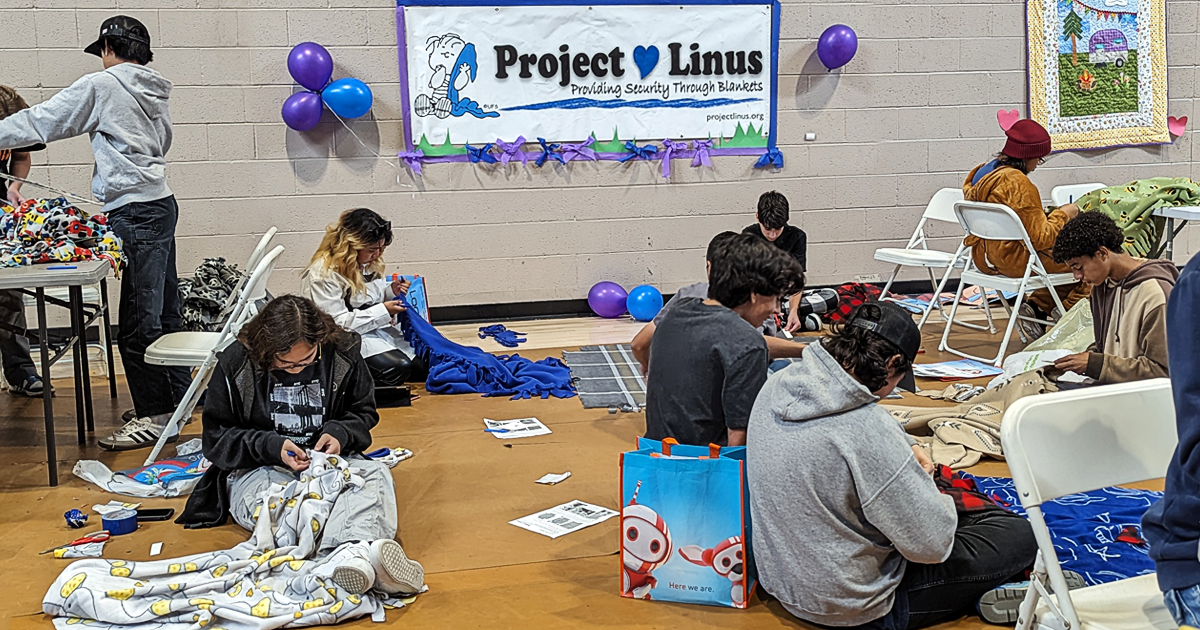

- Community Involvement: Credit unions are actively involved in their communities, supporting local businesses and nonprofit organizations through sponsorships, donations, and volunteerism. Credit unions also provide financial education and outreach to members.

- Specialty: A credit union is set up to serve the unique financial needs of smaller groups of people, so they are often specialists in your community’s unique financial needs.

- Mission-Driven: The core mission of credit unions to serve their members' best interests leads to a business model that prioritizes financial health and well-being over profit maximization.

- Ownership: As a member-owner, you have a voice in how the credit union operates and can actively participate in decision-making processes.

- Convenience: Many credit unions are part of extensive networks, providing their members with access to fee-free ATMs and branch services across the country, enhancing convenience.

How Do You Become a Member?

The field of membership for a credit union may vary depending on the institution. This can include living in a certain geographic area, belonging to a particular profession or organization, or being a family member of an existing member.

If you'd like to join us at Logix, the process is straightforward and inclusive. To become a member, all you need in order to establish an account is a completed application which includes proof of eligibility, and a minimum deposit of $5 to fund your new account. The $5 deposit is not a payment to Logix, but rather your share in the credit union, which is held in your savings account for the entirety of your membership.

You can become a member by joining online, by calling us at (800) 328-5328, or by applying in person at one of our branch locations. Simply stop by or make an appointment here. Eligibility for Logix membership includes:

- Employees and retirees of Logix sponsor companies, groups, and associations

- Family members of a current member by blood, marriage, or shared residence

- Or, you can qualify by joining, at no cost, the following non-profit organization:

- The American Consumer Council, a non-profit membership organization founded in 1987 and dedicated to consumer education, advocacy and financial literacy.

Once you become a member, you’re in! You become part of an elite membership of peers who benefit from the alternative banking experience that is Logix Federal Credit Union. Now that is smarter banking. If you have any questions or require further guidance, don't hesitate to reach out to us. We're always here to help!

-------------------------

Please contact Logix at (800) 328-5328 or visit www.lfcu.com if you have any questions about this topic or would like to consider opening an account.

Logix membership is available in the following states: AZ, CA, DC, MA, MD, ME, NH, NV, and VA.

Logix Smarter Banking is a registered trademark of Logix Federal Credit Union.

NMLS ID: 503781