Dear Valued Members,

Given recent events in the banking industry, including the sudden shuttering of Silvergate Bank and the FDIC’s takeover of Silicon Valley, Signature, and now First Republic Bank, I saw an opportunity to reach out about your relationship with Logix. At times like this, it’s nice to be reminded of the security of your deposits and our long-standing commitment to your financial health. Times like this can also be eye-opening; we’ve experienced an increase in calls from individuals who are moving funds to Logix over concerns with their bank's safety. Besides competitive rates and trustworthy service, it would be hard to find a safer home for your deposits – particularly those exceeding $250,000.

- Excellent Liquidity – Logix has more than $7.4 billion in stable, well-diversified deposits, along with $4.4 billion in unused borrowing capacity at the Federal Home Loan Bank and Federal Reserve Bank

- Conservative Investments & Strong Balance Sheet – Logix maintains conservative investment and balance sheet management practices. We have no exposure to recently failed banks or cryptocurrency assets. In contrast, Silicon Valley Bank and First Republic Bank were heavily concentrated in startup companies and venture capital firms, while Silvergate and Signature Banks were heavily focused on banking crypto-related companies

- 5-Star rating – Logix consistently earns the highest possible rating for financial strength, as measured by industry analyst, Bauer Financial

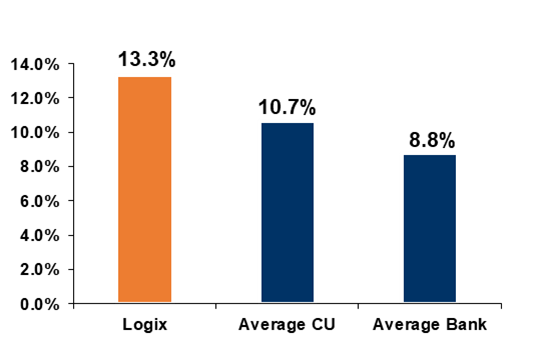

- Strong Capital Position – Our net worth (or capital) is 13.3% of assets, well above the 7% threshold our regulators, NCUA, require to be well-capitalized, and significantly above the bank average of 8.8%

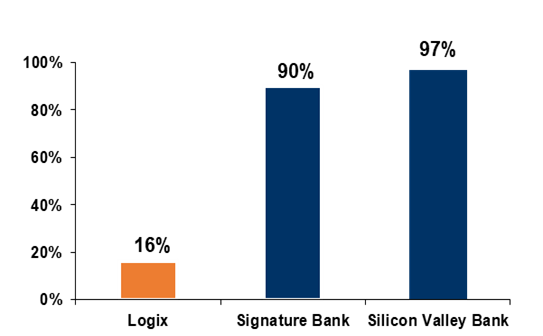

- Federally Insured – Member deposits are federally insured to at least $250,000 per individual vesting, with another $250,000 allowed for IRAs. Today, only 16% of member deposit balances are uninsured. By opening accounts using different individual/joint ownership structures, a family can secure coverage well above the federal insurance limit

- Positive earnings – Your credit union maintained a perfect record of positive earnings over our 86-year history, including the great financial crisis of 2008. Click here to review our most recent audited financial statements

Ana E. Fonseca

President and CEO

Logix is safe and strong

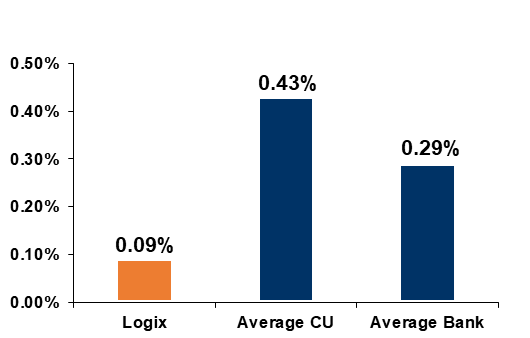

Here's how a few important financial ratios compare to the industry.

|

Net Worth (Capital) |

Uninsured Deposits to Total Deposits |

|

|

|

Logix capital ratio (also known as net worth or retained earnings) is well above the amount required by regulators. Logix capital provides a cushion of more than $606 million to protect member deposits, in addition to the federal insurance guarantee of at least $250,000 per individual vesting. |

Compared to Signature Bank and Silicon Valley Bank, Logix uninsured deposits represent only a small portion of total deposits. Logix maintains conservative investment and balance sheet management practices to ensure liquidity remains robust. |

|

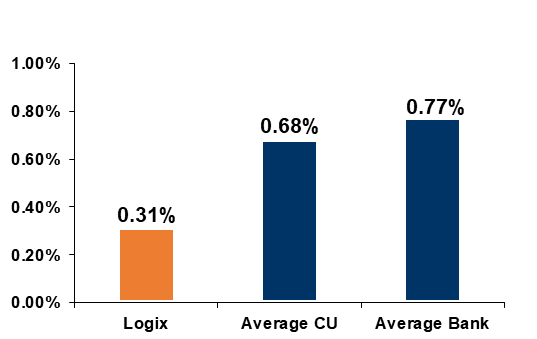

Loan Charge-off Ratio |

Loan Delinquency Ratio |

|

|

|

Logix net charge-off ratio is 0.09%, which means only a fraction of the loans we make result in a loss. Logix has never participated in subprime mortgage lending. |

History shows that delinquency is an indication of future loan losses or charge-offs. We carefully review and underwrite all loan requests, and our lending policies remain conservative. |

The charts above show Logix Federal Credit Union’s financial results as of 12/31/22. Bank and Credit Union averages are current as of December 31, 2022 (the most recent period available) and are based on institutions with $3 billion or more in assets. Source: NCUA.gov and FDIC.gov.

-------------------------

*Please contact Logix at (800) 328-5328 or visit www.lfcu.com if you have any questions about this topic or would like to consider opening an account.

Logix Smarter Banking is a registered trademark of Logix Federal Credit Union.

Financial Strength Star Ratings current as of 3/13/23, based on 9/30/22 financial data (the most current available). Criteria are used to determine the BauerFinancial™ Star-Rating includes capital ratio, profitability/loss trend, evaluating the level of delinquent loans, charge-offs and repossessed assets, the market versus book value of the investment portfolio, regulatory supervisory agreements, historical data and liquidity, and other factors. Logix financial results current as of 2/28/23. Your savings are federally insured to at least $250,000 by the NCUA, a U.S. Government Agency.

%20(952%20x%20317%20px)-2.png)