Fact: Credit unions charge fewer fees and have better loan and deposit rates, on average, than banks.

But don't take our word for it.- “Credit unions offer higher interest rates on savings accounts and lower rates on loans—exactly what consumers want." Forbes

- “Credit unions will likely offer you lower-cost services and better interest rate options for both loans and deposits.” Investopedia

- “On average, credit unions tend to offer higher interest rates on deposits and lower rates on loans.” Nerdwallet

Fact: Logix Federal Credit Union charges fewer fees and has better loan and deposit rates, on average, than other credit unions.

By taking your banking relationships from a bank to a credit union, you’ve already made a smarter banking decision. Congratulations! But Logix is no ordinary credit union.

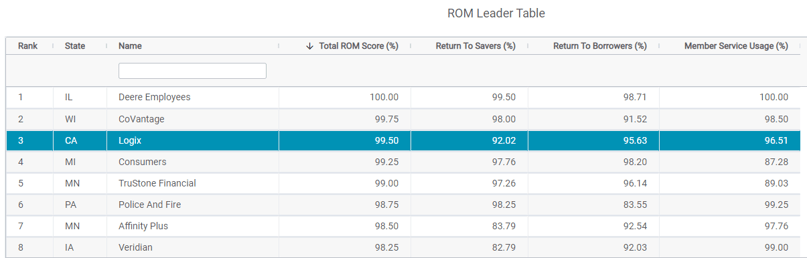

- Logix is ranked in the 99th percentile for member value among credit unions nationally. (Callahan and Associates)

- As of Q3 2022, Logix scored 99.50 out of a possible 100. The average credit union scored 49.09. (Callahan and Associates)

- Logix is the highest scored credit union in California. (Callahan and Associates)

- Logix has been in the 95th percentile or above since 2014 and in the top 10% for more than 20 years! (Callahan and Associates)

- Logix charges 18.8% fewer fees than the credit union average. (Callahan and Associates)

Conclusion: Credit unions offer more value than banks, and Logix offers more value than more than 99% of peer credit unions. The smarter banking choice is easy.

Eager to know more?

Callahan and Associates is an unbiased 3rd party that measures over 400 peer credit unions with the stated goal of “empower(ing) credit unions to impact their members and communities in meaningful ways.”

The total Return of the Member (ROM) score measures thousands of credit unions and is a combination of the three core credit union functions: savings, lending, and product usage in comparison to its asset-sized peer group.

- Savings - Return to the Savers score of 92.02. The first component of the ROM analysis is Return to the Savers. It measures how well a credit union is providing deposit services to its members, in addition to the change in average balance, number of share accounts per member, and the three-year share growth of the credit union.

- Lending - Return to the Borrowers score of 95.63. The lending component, Return to the Borrowers, recognizes credit unions that offer a lower rate on loans, but it also considers the historical growth in lending and the variety of products offered to its members.

- Product Usage - Member Service Usage score of 96.51. This final component measures how efficiently a credit union provides and promotes its services to members. The leaders here are those that have a high number of core account relationships with their members.

We’re grateful to Callahan and Associates for providing such concrete evidence of our service and value commitment to you, our members.

-----------------------------------------

*Logix Federal Credit Union is not affiliated with any outside sources, and is a separate entity.

Please contact Logix at (800) 328-5328 or visit www.lfcu.com if you have any questions about this topic or would like to consider opening an account.

Logix Membership Required.

%20(952%20x%20317%20px)-2.png)