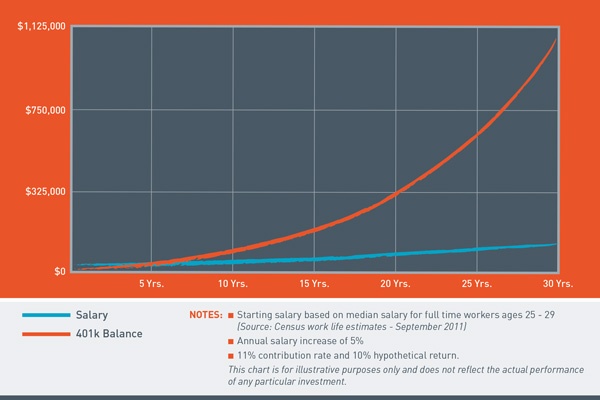

We’d like to introduce you to compound interest. It’s a simple principle that works consistently in practice. When you invest, your investment starts to earn money. Then the gains it accumulates also start to earn money and your initial investment can snowball very quickly.

The younger a person is when they begin taking advantage of compound interest, the more this snowball grows!

Did you know that if you invest $1,000 once a year ($83 a month) in an investment that averages a 10% annual return – the average annual stock market return since 1926 – it could grow to more than $1 million after 46 years?¹

Or that if you up the ante to just $166 a month – which is probably less than you spend on clothes and entertainment – you'll hit the $1 million mark in just 39 years?

Just remember, though, that investments in the stock market are not FDIC or NCUSIF insured, so subject to risks including the possible loss of principal amount invested. If you still want your money to pay interest dividends, but without as much risk, check out our insured deposit offerings such as Money Market Accounts, IRAs and Share Certificates.

For too long, too many Americans have been living “buy now, pay later” lifestyles. We know where that leads. Take this opportunity to "save now, build wealth for later" by learning about the benefits of saving and investing.

Most importantly, share this post with the young people you love. Remember that the power of compound interest grows with time.

Learn more about the power of compound and our variety of compound interest calculators by clicking here.

-------------------------

¹ The Motley Fool, www.fool.com. Investing in the stock market involves risk. Performance is not guaranteed.

%20(1200%20x%20628%20px)%20(952%20x%20317%20px)-1.png)

%20(2)-1.png)

.png)

%20(952%20x%20317%20px)-2.png)