Laddering your certificates is an attractive investment strategy for new and seasoned investors looking to diversify their portfolios. With laddering, you will be able to decide how you want to split up your investments and whether to reinvest each time a certificate matures. By opening multiple certificates with staggered maturity dates, you have the potential to earn better returns while keeping your money safe.

These investment instruments can provide a sense of security in uncertain times, as they are meant to hedge against rate uncertainty and reinvestment risks. Certificate accounts, when opened at federally insured institutions, are a safe investment because they are insured for up to $250,000 by the National Credit Union Administration at credit unions or the Federal Deposit Insurance Corporation at banks. Maturity dates for these accounts vary, and typically the higher the term for funds committed, the higher the dividend rate paid.

It's important to consider the trade-offs when choosing whether this is the best option for your personal savings goals. Since certificate accounts can increase your investment earnings while reducing risks, the rates of return are typically lower than those higher-risk, non-insured assets such as mutual funds, stocks, and other investment options. Furthermore, since they are time deposit accounts, withdrawing funds before the maturity dates often trigger penalties and fees. Investors should also consider the impact taxes could have on their earnings.

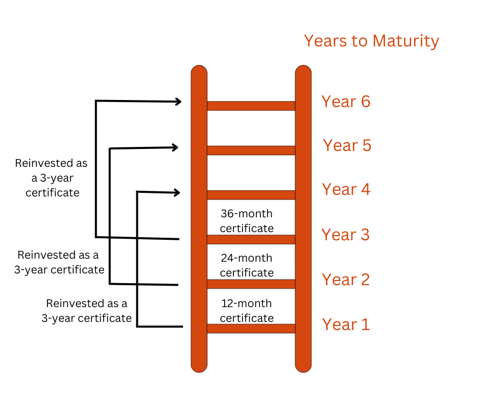

Certificate Laddering Sample

Building a ladder is simple. You can adjust the ladder to your needs, based on how much money you want to invest, how many certificates you'd like to open, and how soon you need to access the funds. You can create a custom schedule that staggers maturity times to increase liquidity and benefit from higher rates. Then, use that information to create your ladder. Here's an example of how laddering might work. Say you have $3,000 to invest. You could put it all in one certificate, but you might miss out on an opportunity in the future to reinvest those funds in a higher yielding account. Instead, you might build a three-year ladder with different maturity dates. Each certificate is a "rung" on the ladder. By splitting your investments, you will have different maturity dates and varying dividend rates, thereby maintaining a more consistent track with the market.

- $1,000 in a 12-month certificate at 2.30% APY

- $1,000 in a 24-month certificate at 2.60% APY

- $1,000 in a 36-month certificate at 2.40% APY

As each certificate matures, you'll either reinvest those funds into another certificate by repeating the staggered intervals or withdraw the funds. This way, you'll still have access to a portion of your funds, but you'll "ladder up" these investments over time and earn the highest rate available when you reinvest. Certificates don't need to be in equal amounts or spaced at yearly intervals.

As each certificate matures, you'll either reinvest those funds into another certificate by repeating the staggered intervals or withdraw the funds. This way, you'll still have access to a portion of your funds, but you'll "ladder up" these investments over time and earn the highest rate available when you reinvest. Certificates don't need to be in equal amounts or spaced at yearly intervals.

The laddering structure you choose should factor in the pros and cons, as well as how soon you need the money. An effective strategy may give your savings a boost while offsetting the risks, thus providing a well-rounded portfolio.

Ready to start building your own laddering strategy? Logix members can open a new certificate account by logging in to Online Banking or by calling us at (800) 328-5328.

Not a member yet? Apply for a Logix membership at your nearest branch or online.

-------------------------

*Please contact Logix at (800) 328-5328 or visit www.lfcu.com if you have any questions about this topic or would like to consider opening an account.

APY means Annual Percentage Yield.

Waiver of certificate early withdrawal penalty: Logix will waive your early withdrawal penalty if you decide you want to invest funds from your Certificate in the market. Restrictions apply. Click here for details. Rates Effective February 3, 2023 through February 9, 2023 and are subject to change.

%20(1200%20x%20628%20px)%20(952%20x%20317%20px)-1.png)

%20(2)-1.png)

.png)

%20(952%20x%20317%20px)-2.png)