When you hear the word “investment”, what thoughts come to mind? Do you think “that is a beast of a word and I’d rather not think about it?” Or, do you think about possibilities, strategies, wealth management and retirement? For the longest time I avoided the word, pretending it didn’t exist. Anytime investments came up in conversation with my peers, I did one of those agreeable “yeah, definitely! I invest in x, y, and z all the time and am so stock savvy.” In my head, however, I was thinking about how I have no idea what they are talking about nor what I am talking about and I just want to find a corner of the room to escape to.

I grew up in a family that didn’t talk about money or how to save it properly (or multiply it even) and I believe that is part of the reason for my apprehension in investing. I just lack the knowledge. Now, to blame myself a bit – I’ve been interested in investing since 2009 when I started working for Logix and building a retirement (with an excellent employer-match incentive), but I’ve put off utilizing the resources around me that would help me understand how my future dollars are being allocated. There are no excuses guys - I even sit right next to one of our brokerage experts! And, do you know what gem he showed me when I timidly went to pick his brain? Feast your eyes on this – a Logix Financial Services site with the answers to our questions and the fuel to our investment and financial conversations at our fingertips. It was that easy!

This site houses videos, newsletters, calculators, a glossary of financial terms and more! As a visual learner, I gravitated toward the “Flipbooks.” They’re loaded with tips and information on several different financial topics. The beautiful photos with animated page flip sounds are the icing on the cake. I knew upon seeing them that I needed to dig into the “Investing Basics” one immediately.

The Investing Basics flipbook breaks down what exactly investing means and helps you identify your financial goals by providing details on a variety of portfolios, stocks and bonds. It essentially provides an overall picture of investment-speak with a page in there about procrastination and why we do it – it’s almost as if that page was written for me!

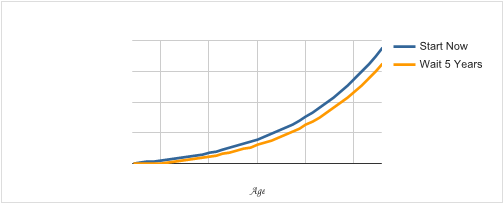

As I mentioned earlier, in 2009, I officially started a retirement account that I promised myself I would leave alone and let flourish. Prior to that, I had a retirement savings that had been accumulating dollars for only a couple of years when I decided to cash it out and move across the country. I can be just a tad impulsive and didn’t quite understand the importance of a retirement account and now I need to play catch-up. The calculators within this Logix Financial Services site help provide additional insight on a variety of financial topics. Similar to the flipbooks, they are another tool that can be used to provide hypothetical examples. At this particular moment, I’m interested in the “Cost of Retirement” calculator as I would like to have an idea of what I may need in retirement and where I could potentially make improvements. One of my favorite parts about this calculator was the surprise thrown in at the end – “The Cost of Procrastination” and the possible difference between starting now and waiting 5 years…who me??

I’ve barely started my investing exploration, but wherever you are in life and whatever your knowledge on the subject, this site houses worthwhile information for everyone. I know I’ll be checking out the video on Data Breaches next and then will make my way over to the “A New Chapter for Retirement” article. After building my knowledge base a little more, I’ll be reaching out to a financial consultant for a more tailored-to-me plan because as much as I enjoy this self-learning Internet world, picking a live person’s brain will forever be so invaluable.

|

Investment Products offered are: • NOT A DEPOSIT • NOT FDIC OR NCUSIF INSURED • NOT GUARANTEED BY Logix Federal Credit Union or ANY CREDIT UNION • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • MAY LOSE VALUE |

%20(952%20x%20317%20px)-2.png)