We’ve previously shared about employment scams, where fraudsters prey on victims looking for jobs. In a typical employment scam, the fraudster poses as an employer and sends the victim a check with instructions to deposit it into the victim's account, keeping a small portion of the check for themselves and wiring the remaining balance to another account. A few days later, the deposited check returns on the victim’s account (as a counterfeit, account closed, or other non-payment reason), leaving the victim responsible for the lost funds.

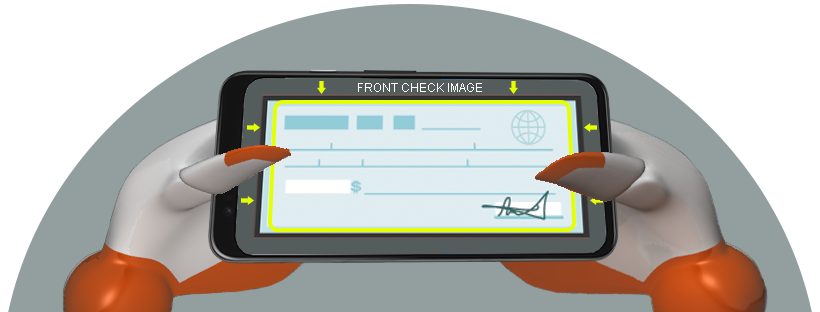

With improvements in technology, it was only a matter of time before we would begin seeing employment scams take on another form: Mobile Deposit Fraud. Similar in nature to the check scam described above, Mobile Deposit Fraud takes advantage of a quick and convenient means of depositing checks – eDeposit.

How Mobile Deposit Fraud Works

In this version of the scam, the fraudster deposits a check to the victim’s account electronically instead of mailing them a check. The victim is instructed to provide their account number and, in some instances, their online and mobile banking credentials. With access to the victim's account, the fraudster deposits a check using eDeposit and transfers the funds to another account by wire transfer, a peer-to-peer (P2P) service such as PayPal or Venmo, or other electronic transfer. By the time the check returns on the victim's account, the fraudster has run off with the money they transferred and the victim is left responsible for the loss of funds.

How to Protect Yourself

- Never give out your personal information. Keep your account numbers, usernames, and passwords safe. An employer would never need you to deposit a check in order to send money elsewhere and would never pay you from a portion of a check. You are the owner of your account – do not hand that control over to someone else.

- Monitor your account activity. Get in the habit of reviewing your activity daily or weekly and immediately report any suspicious activity to your financial institution.

- Trust your gut instincts. If it all sounds too good to be true, it probably is.

If you provided your banking credentials to another party, contact your financial institution as soon as possible. They will help ensure your account is protected and may need to change your account number to prevent fraud from occurring. If you received a check that you are unsure about, do not deposit it – contact your financial institution instead. They will ask you a few questions to help identify the source of the check and may be able to verify its legitimacy. Your financial institution can only help if you are willing to share your suspicions. If you have fallen victim to a mobile check scam or received a fraudulent check, visit the FTC Complaint Assistant to report it.

Employment scams are devastating, often with no recourse for the victims. It’s important to remain vigilant of scam techniques and how they evolve with technology. You'll find articles on a range of fraud topics by visiting the Logix SmartLab blog and the Logix Security Center. If you are suspicious about a job offer, check you received, or electronic transfer request, contact us.

%20(952%20x%20317%20px)-2.png)