As of September 21, 2018, freezing and unfreezing your credit is now free. Under a new federal law, you will no longer need to pay a fee for freeze requests, and fraud alerts on credit reports are now valid for a year, extended from the prior timeline of 90 days.

Imagine finding a pile of cash on the ground, let’s say $1,000. No one’s around and you can’t spot the person who may have dropped it. What do you do? Many of us would pick it up and turn it in, possibly to the police, but there are people out there for whom the dollar signs would take over and that money would end up in their pocket.

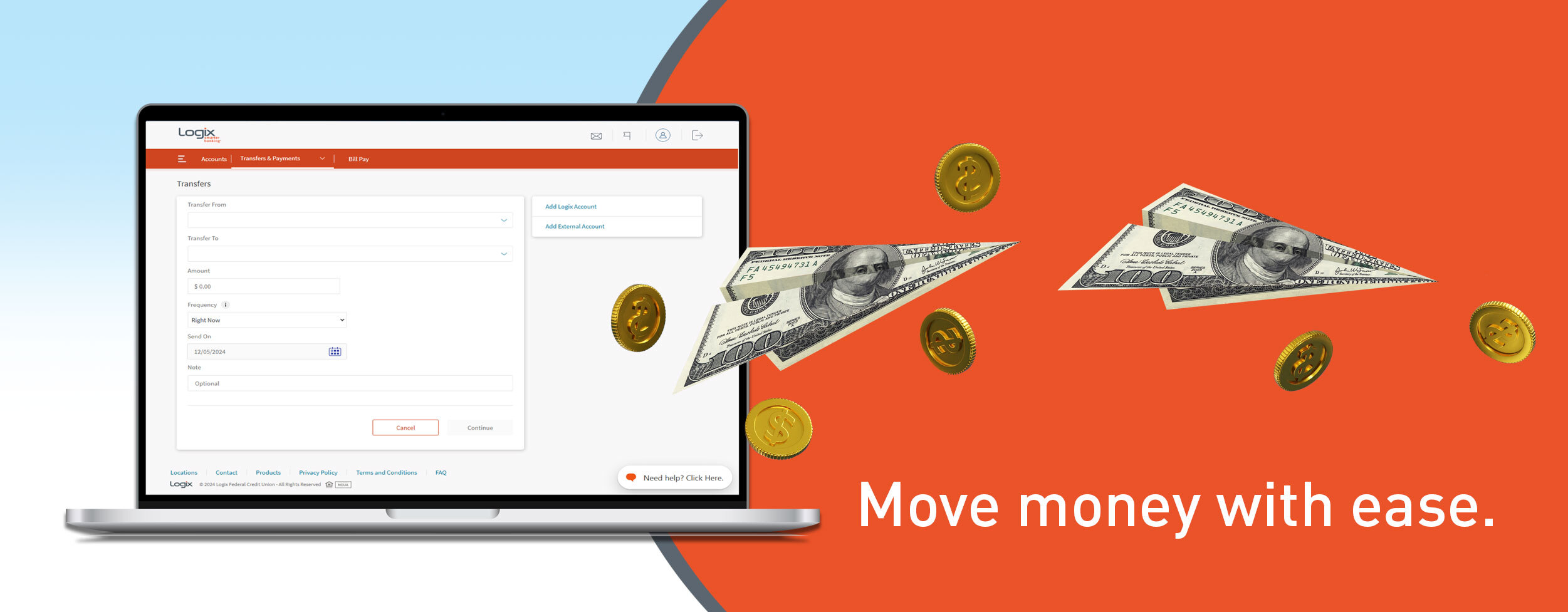

Pay back your best friend for lunch? Easy.

Transfer money to your sister for your parent’s anniversary gift? Easy-peasy.

Unsuspectingly transfer money to a scammer. Yes, all too easy.

Peer-to-peer (P2P) apps, such as Zelle, PayPal, Venmo, and Square have increased in popularity and earned a spot as an efficient means of transferring money quickly to other parties. This method of transferring funds is not only a plus for consumers, but fraudsters as well who are always on the prowl for new ways of scamming their victims.

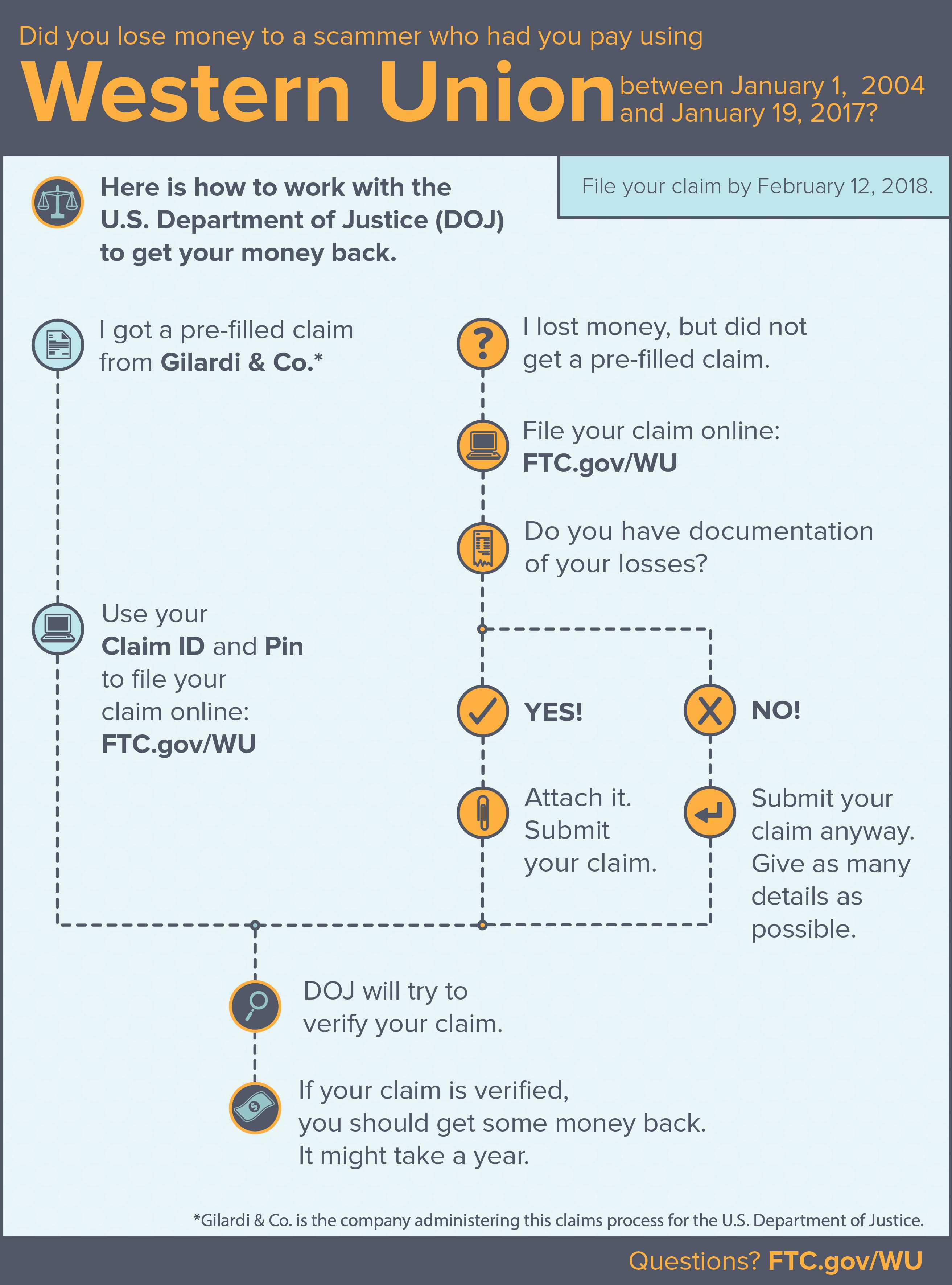

FTC Announcement Regarding "Western Union Refunds"

The Federal Trade Commission (FTC) recently announced some good news for those who fell victim to scams involving wiring funds via Western Union: they can submit a claim by February 12, 2018 to get their money back.

%20(952%20x%20317%20px)-2.png)